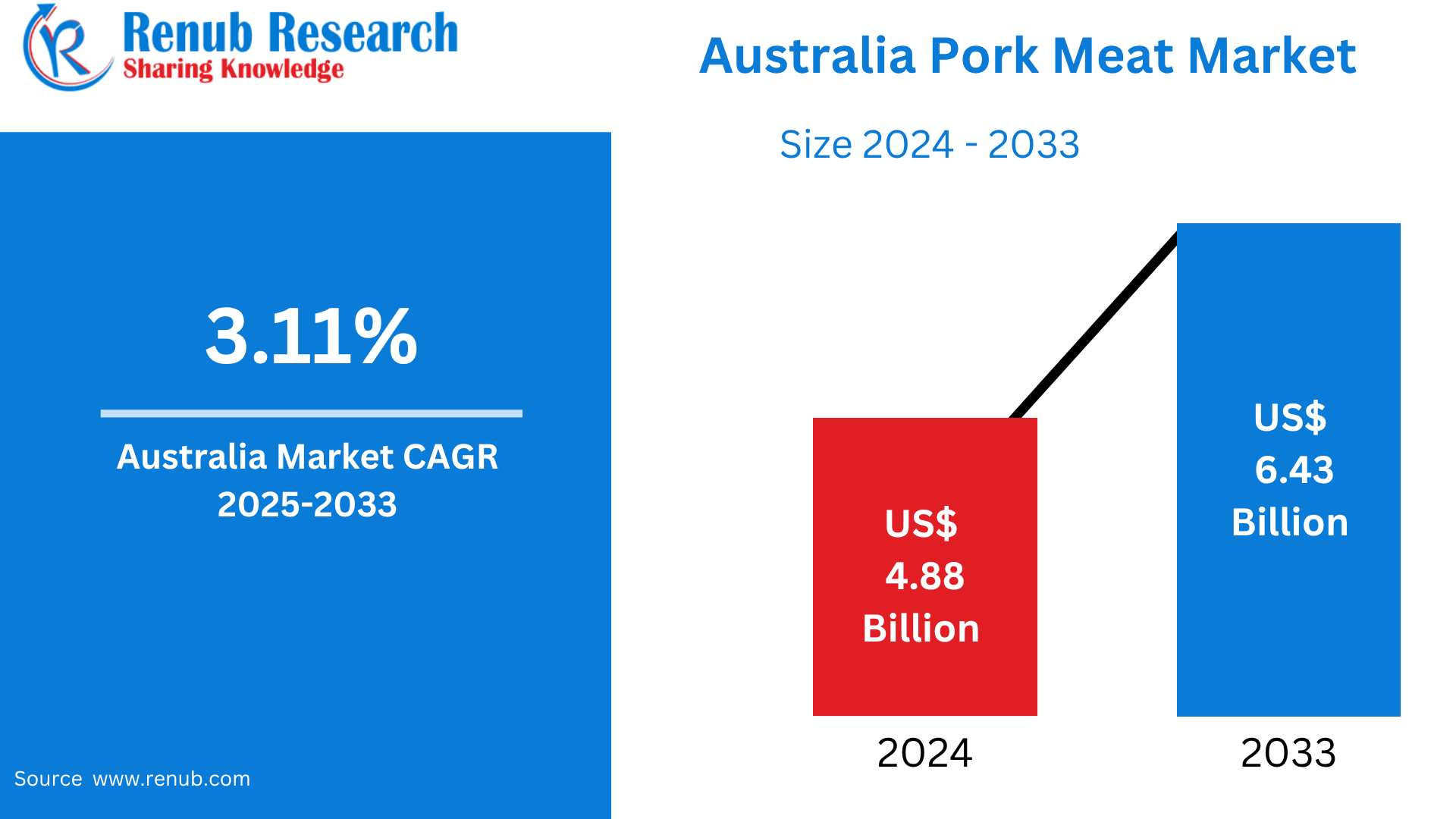

Renub Research predicts the Australia Pork Meat Market will grow from US$ 4.88 billion in 2024 to US$ 6.43 billion by 2033, expanding at a CAGR of 3.11% from 2025 to 2033. This press release presents a deep dive into the future of pork consumption across Australia, analyzing changing consumer preferences, technological advancements, and regional growth patterns.

👉 Explore the full report here: Australia Pork Meat Market

📈 Market Overview

Australia’s pork industry is undergoing significant transformation due to the convergence of dietary shifts, technological innovation, and retail modernization. As health-conscious consumers increasingly opt for protein-rich diets, pork continues to gain acceptance not only in traditional households but also in gourmet and quick-service food segments.

In 2024, the market was valued at US$ 4.88 billion, with chilled pork dominating consumption. The industry is expected to grow steadily, reaching US$ 6.43 billion by 2033, underscoring pork’s growing role in Australia’s evolving culinary landscape.

🚀 Key Drivers Fueling Market Growth

1. 🌱 Protein-Based Dietary Trends

As plant-based diets plateau and flexitarianism rises, consumers are seeking lean animal protein sources. Pork, with its diverse cuts and lean meat options, aligns with this demand.

2. 🏙️ Rising Urbanization and On-the-Go Lifestyles

Australia’s urban population prefers quick-cooking, versatile ingredients. Pork-based dishes offer speed and flavor, making them ideal for fast-paced metropolitan routines.

3. 🏭 Technological Advancements in Meat Processing

Enhanced packaging, safety, and cold chain logistics have significantly boosted chilled pork consumption. Innovations like vacuum packaging and smart labeling enhance shelf life and consumer trust.

4. 🛍️ Surge in Online & Omnichannel Distribution

E-commerce platforms and meal delivery kits are offering pork products directly to consumers, expanding reach beyond traditional supermarkets.

5. 🍴 Expanding Foodservice Sector

Restaurants, cafés, and fast-food chains are introducing pork-based items like pulled pork, bacon wraps, and pork ribs, broadening the consumer base.

🧊 Market Segmentation Insights

🥩 By Product Type

- Chilled Pork Meat: Leading the segment due to better texture, taste, and freshness perception.

- Frozen Pork Meat: Gaining traction for long-term storage needs, especially in rural and export markets.

🏠 By Application

- Household: Continues to be the largest segment, especially among multicultural families that incorporate pork in daily meals.

- Commercial: Foodservice and hospitality sectors are increasingly adopting pork into premium and fast-food menus.

🛒 By Distribution Channel

- Supermarkets & Hypermarkets: Remain the dominant retail channel.

- Specialty Stores: Cater to specific ethnic or gourmet pork demands.

- Online Retail: Growing rapidly, offering subscription models and pre-portioned packs.

- Others: Farmers’ markets and direct-from-farm channels are gaining popularity.

📍 Regional Landscape

The pork market is flourishing across major Australian states, driven by localized consumer preferences and infrastructure development.

- New South Wales & Victoria: Lead the pack due to dense urban populations and vibrant food cultures.

- Queensland & Western Australia: Experiencing rising demand due to population growth and retail expansion.

- South Australia & Tasmania: Contributing through sustainable farming practices and premium pork offerings.

🧪 Innovation Spotlight

Companies are introducing antibiotic-free pork, organic cuts, and carbon-neutral meat products to appeal to eco-conscious and health-savvy consumers. Advanced traceability systems are also being adopted, allowing consumers to track their pork from farm to fork.

🌍 Export Potential

While domestic consumption is strong, Australia’s pork exports to Asian markets—especially Singapore, Hong Kong, and Vietnam—are growing due to the country’s reputation for high-quality, biosecure pork.

🔍 Competitive Landscape

Leading players in the Australia pork meat market are:

- SunPork Group

- Rivalea Australia Pty Ltd

- Australian Pork Limited (APL)

- JBS Australia

- Tegel Foods Ltd

These companies are focusing on vertical integration, branding strategies, and expanding product lines to maintain competitive edge.

🔮 Forecast Outlook

The market’s trajectory is steady, backed by innovation, shifting dietary preferences, and retail evolution. The 3.11% CAGR underscores pork’s resilience in a market often shaped by alternative protein hype.

By 2033, pork will solidify its role in the Australian diet—not just as a household staple but also as a gourmet, sustainable, and ready-to-eat solution.

❓ Frequently Asked Questions (FAQs)

1. What is the current size of the Australia Pork Meat Market?

As of 2024, the market is valued at US$ 4.88 billion.

2. What will be the size of the market by 2033?

It is projected to reach US$ 6.43 billion by 2033.

3. What is the growth rate (CAGR) of the market?

The market is growing at a CAGR of 3.11% from 2025 to 2033.

4. What is driving the pork market growth in Australia?

Key drivers include increasing protein-based diets, urban lifestyles, processing technology advancements, and rising foodservice consumption.

5. Which product type dominates the market?

Chilled pork meat is the leading product segment due to consumer preference for freshness and texture.

6. How is the online channel impacting the pork meat market?

Online retail is expanding access to pork, especially in metropolitan and remote regions, and offering convenience-focused formats.

7. Which regions in Australia are major pork consumers?

New South Wales and Victoria lead consumption due to large urban populations and diverse culinary preferences.

8. Are there any sustainability trends in pork production?

Yes, companies are adopting antibiotic-free, organic, and carbon-neutral practices to align with consumer demand.

9. Is the commercial sector a significant application area?

Yes, the commercial segment is rapidly growing, especially in restaurants and ready-to-eat food segments.

10. Who are the key companies in the Australia pork meat market?

Major players include SunPork Group, JBS Australia, Rivalea, and Australian Pork Limited.

📚 Read the Full Report

For a detailed analysis of segments, regions, trends, and competitive dynamics, access the complete study by Renub Research here:

👉 Australia Pork Meat Market Forecast 2025-2033

New Publish Report:

- GCC Augmented Reality Market Size, Share, Trends & Forecast 2025–2033

- GCC Liquid Biopsy Market Size, Share, Forecast 2025-2033

- GCC Foodservice Market Size and Share Analysis – Growth Trends and Forecast Report 2025-2033

🏢 📊 About the Company

📌 About Renub Research

📈 Renub Research is a Market Research and Consulting Company with more than 15 years of experience, especially in international Business-to-Business Research, Surveys, and Consulting. We provide a wide range of business research solutions that help companies make better business decisions.

We partner with clients across all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

Our wide clientele includes key players in:

- Healthcare

- Travel & Tourism

- Food & Beverages

- Power & Energy

- Information Technology

- Telecom & Internet

- Chemicals

- Logistics & Automotive

- Consumer Goods & Retail

- Building & Construction

- Agriculture

Our core team comprises experienced professionals with graduate, postgraduate, and Ph.D. qualifications in Finance, Marketing, Human Resources, Bio-Technology, Medicine, Information Technology, Environmental Science, and more.

📞 Media Contact:

- Company Name: Renub Research

- Contact Person: Rajat Gupta, Marketing Manager

- Phone No: +91-120-421-9822 (IND) | +1-478-202-3244 (USA)

- Email: rajat@renub.com